Host: Hi, I’m Brian, and welcome to one of the most hotly anticipated events of the year. Tonight I’m here with a very special guest…he’s a serial tech entrepreneur, an angel investor, and one of the most interesting people I know… James Altucher.

James: Brian, thanks for having me here tonight, I can’t wait to get started on we’ve got planned.

Host: Yes, this is the event everyone’s been anxiously awaiting. Under these crazy circumstances we didn’t know when or if we’d even be able to pull this off. But, James, I know you made an amazing sacrifice to be here and to share what you believe is the biggest tech transformation of our lives.

James: Yes, I haven’t been this excited about a new era in tech in over a decade. In the 2010s, this technology revolutionized the world…helping unleash the biggest tech expansion in history. It was a major catalyst behind all of today’s $1 trillion companies.

And now its next phase is about to contribute to a whole new group of winners. For the first time in history, we’re going to witness the number of $1 trillion companies explode… from just four to many times that.

Host: And James I know you’ve said the profits are going to come from companies of all sizes. But will certain size businesses be affected more than others?

James: Absolutely… while this tech is going to help companies of all sizes… including turning some massive bluechip companies into bigger $1 trillion giants… the real opportunity here is going to be if you can find smaller companies about to make that jump.

The $10 to $20 billion stocks who make that gigantic leap into the 12 zeroes club. To give you an idea what kind of profits are at stake… if you own a $20 billion company and it grows to $1 trillion, that stock just increased 50X in value...

And if you own a $10 billion company that hits $1 trillion… well you’re talking about a stock that grew it’s market cap 100X over.

Host: Wow. So that’s what’s at stake here. Now if you’re just joining us, you may be wondering how does a $20 billion company go vertical like that… blasting 50X higher on its way to $1 trillion. Well, it’s all part of the hottest revolution in tech right now… what James is going to show you later tonight.

James: The growth potential here is so big, some of the top venture capital firms in the world are scrambling to get in on this tech trend… including VC firm Sequoia Capital.

Host: Isn’t Sequoia is a pretty big name?

James: Yes, they’re legendary in the VC space… they bought early stakes in two of today’s $1 trillion companies… Apple and Google… and they also famously watched a 2011 investment in Airbnb skyrocket from $260 million to $4.6 billion on IPO day.

Another big VC firm, Andreessen Horowitz, has also invested in start-ups profiting off this trend… and funny enough, just like Sequoia, he also invested $60 million in Airbnb back in 2011.

Host: So let me get this straight… we have two of the largest names in venture capital… firms who both invested early in Airbnb (so clearly they know how to spot tomorrow’s big winners)… And they’re both now buying into this new tech revolution?

James: Yes, and there are at least 23 other VC firms also looking to get exposure to this trend too. All these big players see what I see. So does another tech billionaire Mike Cannon who says about it, "We are at the beginning of a new era of transformation…”

And another tech executive says “100% of businesses need [this new technology].”

Host: That’s why you ran all over town… so you could show people what’s unfolding everywhere they look.

James: Yes and we’ll show that footage later tonight. Because it’s crazy to me, absolutely crazy, that 9 in 10 Americans still have no idea this revolution is even happening. And the truth is, sure we’re still in the early innings of this… but make no mistake, the time to act is now. Once everyone realizes what’s going on, it’ll be too late.

Host: Right, I know you’re doing something extreme to make sure our viewers at home don’t sit on the sidelines while other people get rich. I can’t wait to see which companies you’re convinced have the potential to hit $1 trillion because of this revolution. So if you’re just tuning in now, get ready for the night of your life.

Oh and one last thing before we get started. If you’re planning to record the event, please, please and I can’t get this point across enough… please do not upload this event to social media until the end. We want everyone watching to have a head start on this opportunity over the general public. And with that, welcome again, this is James Altucher’s “To $1 Trillion And Beyond,” here’s a sneak peek of what you can expect.

Host: First up, James is going to show you why this revolution is the #1 place you want to look for tech’s new $1 trillion winners… Then, you’ll discover a shocking secret every tech investor needs to know. It’s why James believes we’re going to see this revolution transform virtually every company on the planet…

James: We’ll also share my “road to $1 trillion formula.” This is the criteria I’m looking at in all these companies right now.

Host: Right and that’s why if you’re watching tonight and wondering if what James is saying is even possible… or if you’ll even learn something new… just hold that skepticism for about 60 seconds.

Because you should know that if there’s one person who can actually predict a $1 trillion winner years in advance… it’s James. And I’m not just saying this. We have video evidence to back this up. Because in 2011, James actually went on national TV to predict Apple would be the first $1 trillion company… seven years before it happened. Let’s play the tape.

Host: They may have laughed at you then, but, James, it’s incredible how prophetic these statements turned out to be. Not only was Apple the first $1 trillion company, that happened in 2018… but in 2020, Apple became the first $2 trillion company, just like you said.

James: Anytime someone laughs in your face like that, you should just take it as a compliment. It means you know something they don’t. I mean look, if someone had bought Apple the day that video aired, you’re talking about turning $5,000 into about $50,000 in a little under a decade. I think most people would be happy with that.

Host: How could you not be? So James now that we have everyone’s attention, I have to ask… how is it that while most people missed out on a trillion dollar opportunity like Apple a decade ago, you were able to see it would become the most valuable company on the planet?

James: Well Brian, believe it or not, it’s because back then I understood the power of disruptive technology, like the kind we’re going to talk about tonight. I could tell Apple’s ability to think outside the box and launch innovative new products was going to change the world. That’s how companies experience exponential growth.

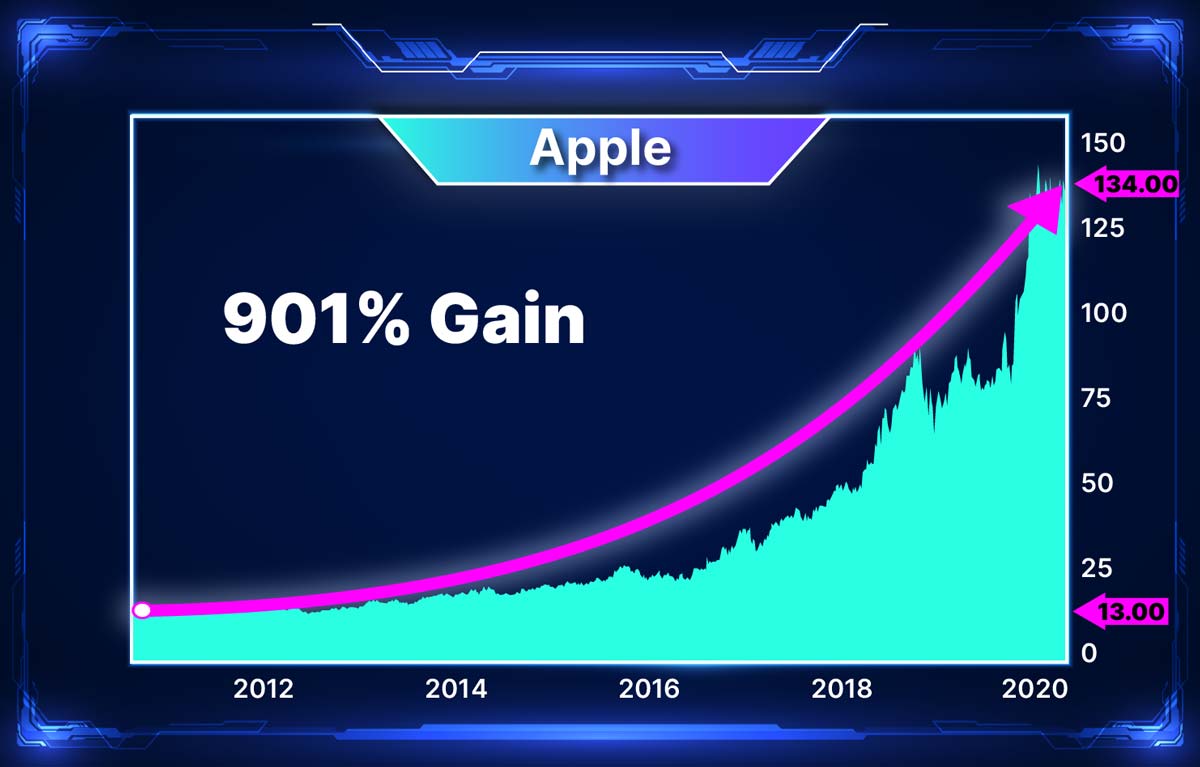

And no wonder, five months after I made that prediction… in October 2011, Apple launched a platform to take advantage of this exact technology we’re about to get into. Since then, the stock has gone up as much as 901%.

Host: That’s incredible. So clearly what you’re talking about doesn’t have anything to do with 5G or self-driving cars. Was it some kind of new chip for their smartphones?

James: Nope. This has nothing to do with the iPhone. And this may shock you, but for once Apple was actually late to the party. In fact, Amazon, Google, and Microsoft all launched platforms to profit from this technology before Apple. Of course, in the end it didn’t matter because they all went on to hit $1 trillion.

Host: I always thought Amazon hit $1 trillion because that’s where everyone goes to buy things.

James: Yeah most people associate Amazon as the winner of the dot com boom… but the truth is… if it weren’t for this technology, I doubt Amazon would be as valuable as they are right now.

In fact, since March 14, 2006, when Amazon relaunched their platform for this technology, shares have gone up as much as 100X. $10,000 invested back then would’ve been worth about $1 million as of September 2020.

Host: Wow. So just investing in 2006 could’ve made someone a millionaire if they had bought Amazon back then. What about the other $1 trillion companies?

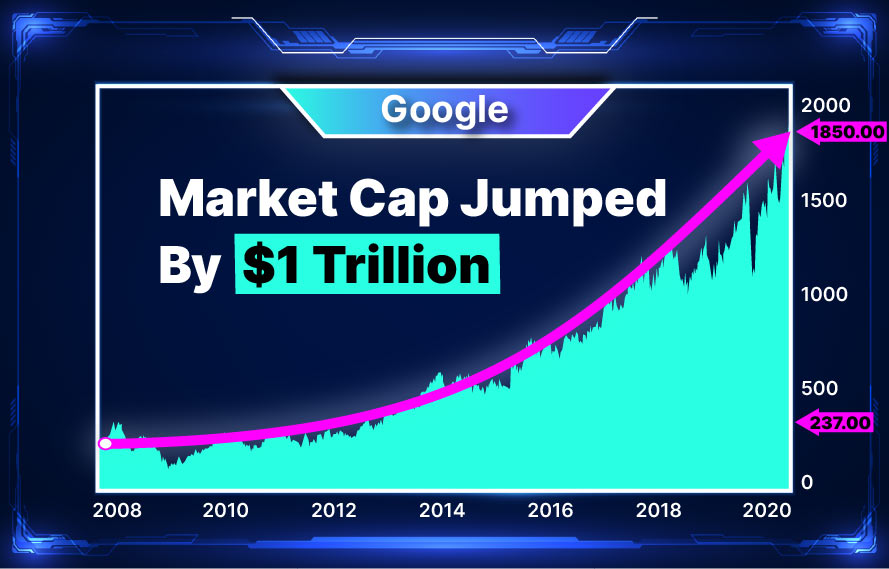

James: Google launched its platform for this technology on April 7, 2008. Since then, the company has added almost $1 trillion to its market cap. Every share bought back then at just $237 would be worth more than $1,850 now.

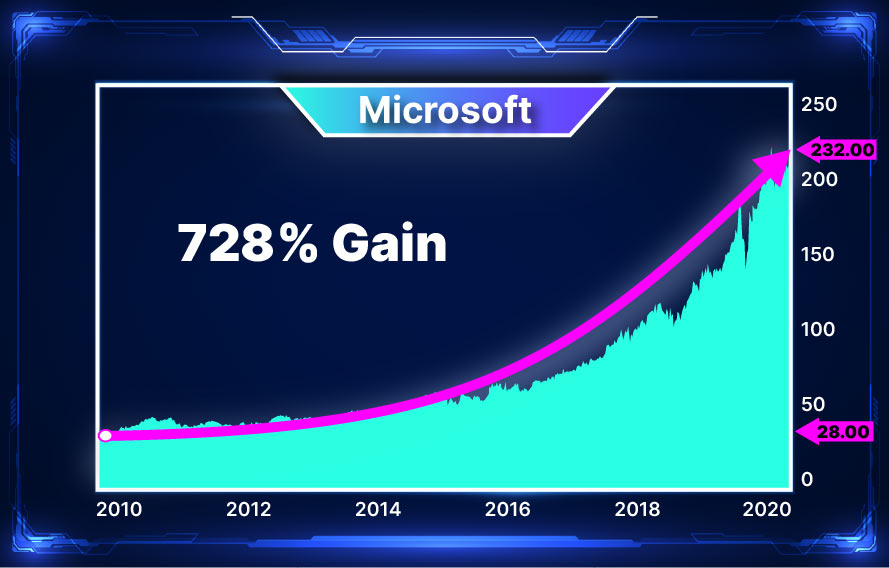

Since Microsoft launched its platform on February 1, 2010, shares have soared from $28 to as high as $232 a piece… a 728% return.

And just to show you the impact this technology had on Microsoft, do you know how much shares moved the decade prior to that?

Host: I can’t say I do.

James: Between February 22, 2001 and February 1, 2010, the stock moved a grant total of 23 cents. 23 cents. Microsoft was one of the worst stocks in the market before it launched its platform for this technology.

Host: Wow. So I think I speak for everyone here, I know I don’t want to miss another $1 trillion winner… can you tell us what the this technology is? What’s this new revolution?

James: Amazon Web Services, Microsoft Azure, Google Cloud Platform, iCloud… If you haven’t guessed, I’m talking about the cloud. And I know the cloud has an awareness problem, but people who still think it’s just a place to store files really missed this opportunity.

I blame the media for getting that wrong. It’s like how back in the 1990s you had those people who thought the internet was only good for sending emails. The breakthrough here makes data storage seem like a footnote. It’s what helped launch Amazon from a nice story into a $1.5 trillion giant.

Host: Wow. I had no idea all these companies’ revenue exploded after innovating because of the cloud.

James: Yes. And the crazy thing is that back then, just like today, it was literally happening in front of everyone’s faces. I mean how many people have bought something on Amazon, or look things up on Google, or run Microsoft Windows, or own an iPhone… Most people right? But how many people think of these stocks as cloud stocks.

Host: Well I know I don’t, so I’d have to say most people don’t either.

James: So let’s do a little experiment here, can you google “cloud stocks” for me on your phone? Let’s see what comes up.

Host: Ok gimme a sec, I’m pulling this up… I’m going to bring my phone over to the camera here so everyone can see this…

James: Pretty amazing right? Amazon, Microsoft, Alphabet (Google) and Apple. That’s all four of today’s $1 trillion+ companies. Did other factors play a part in their success stories? Absolutely. But I have no doubt none of these companies could’ve achieved the success they have now without the cloud.

Host: Now unless I missed something, the cloud as a technology isn’t new right? Like you said, this has been going on for over a decade.

James: Brian you’re right, the cloud was introduced a decade ago… but there’s a new phase in how the technology is being used that’s happening right now. This is the cloud revolution I’m talking about that I’m convinced will transform 94% of companies across America. And all this excitement is why, if you look at cloud companies… practically every single one has been on a tear recently. I mean look at these winners from 2020-2021…

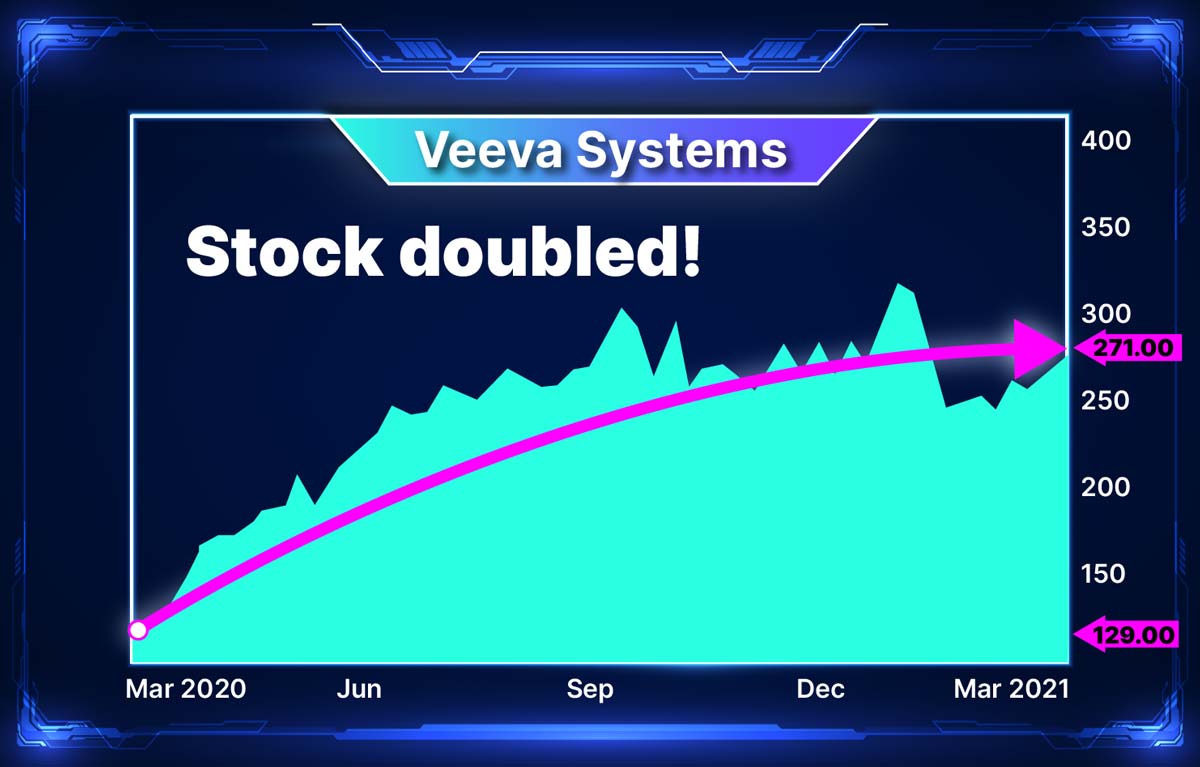

Veeva Systems was a double…

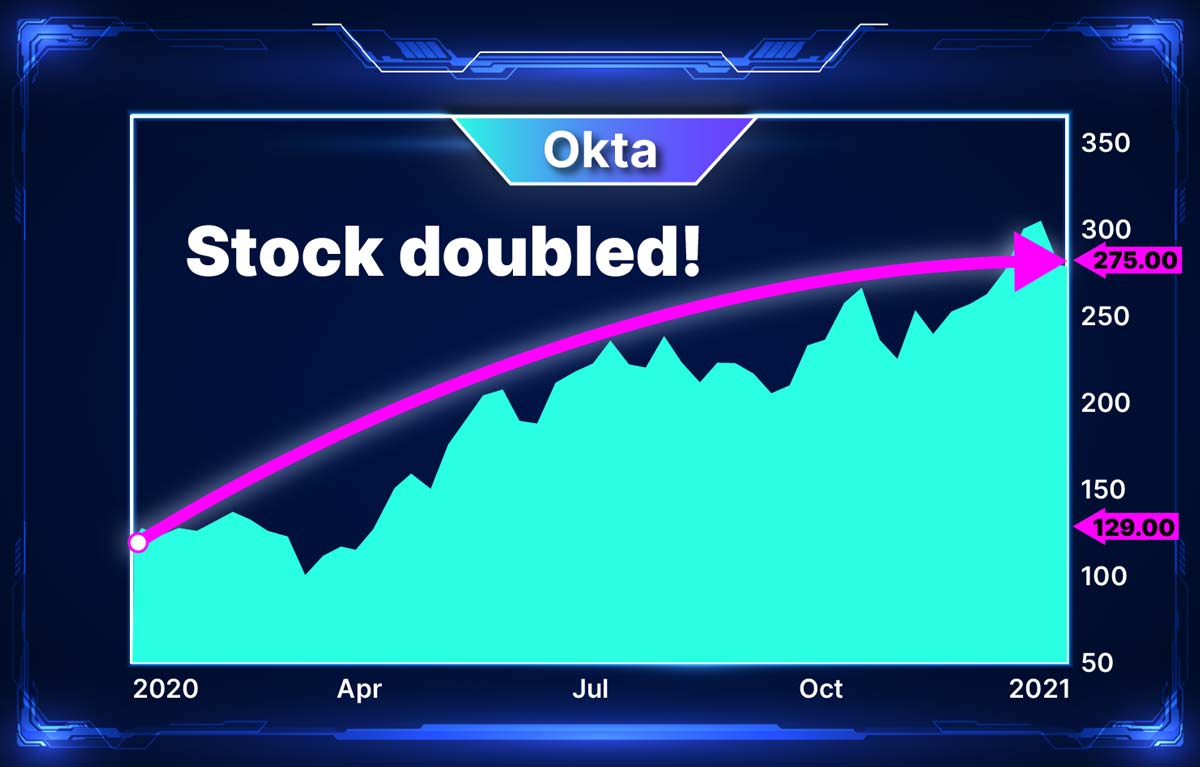

Okta was also a double…

Atlassian has nearly doubled…

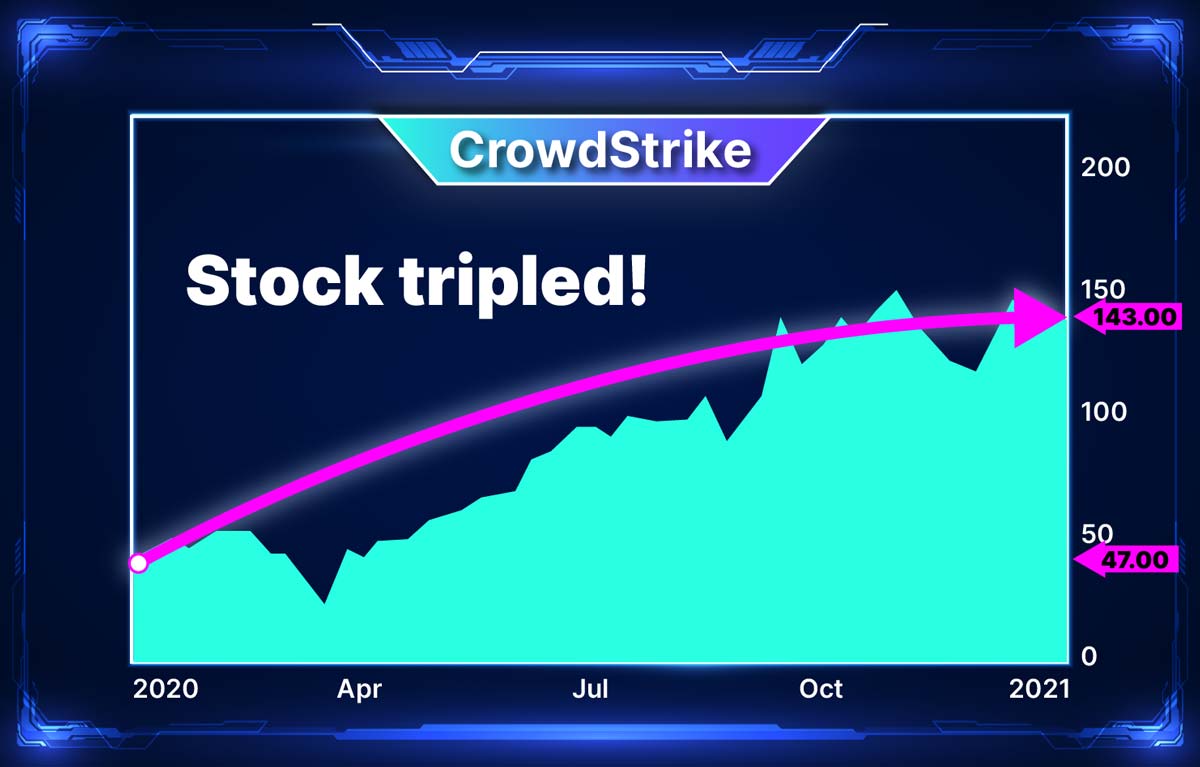

Crowdstrike was a triple at one point…

Twilio has nearly tripled...

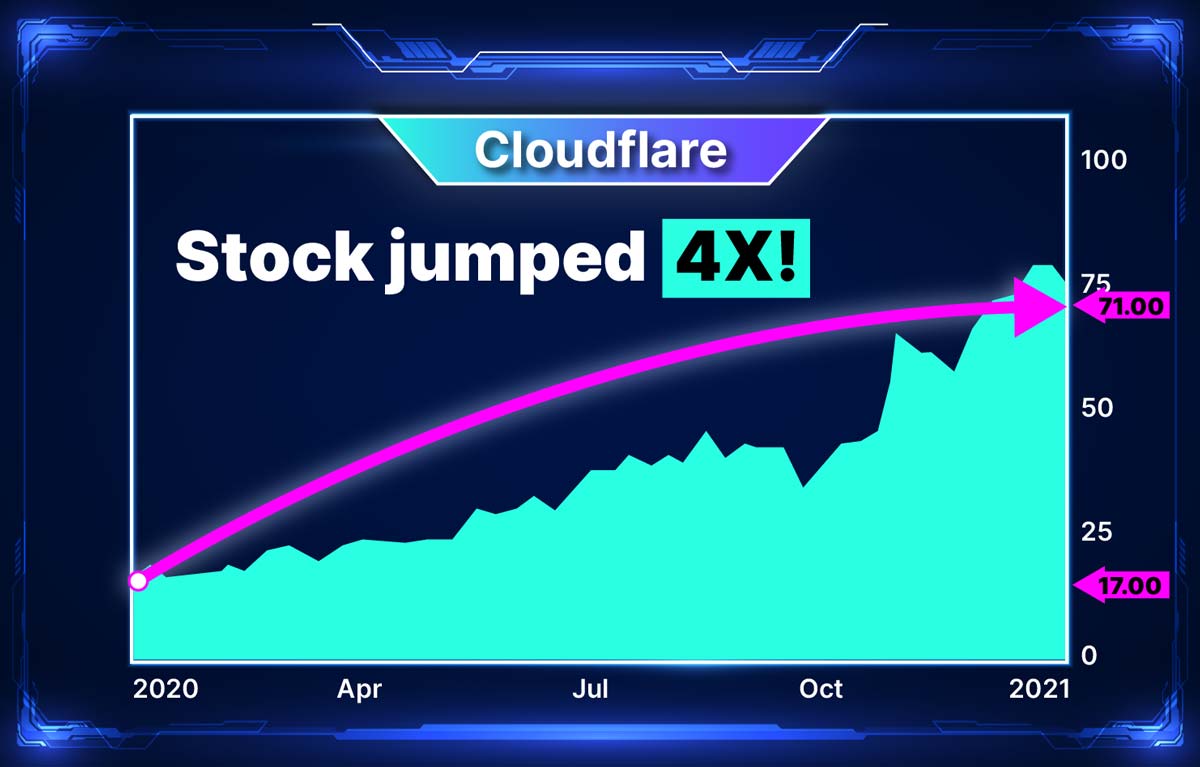

Cloudflare has gone up 4-times…

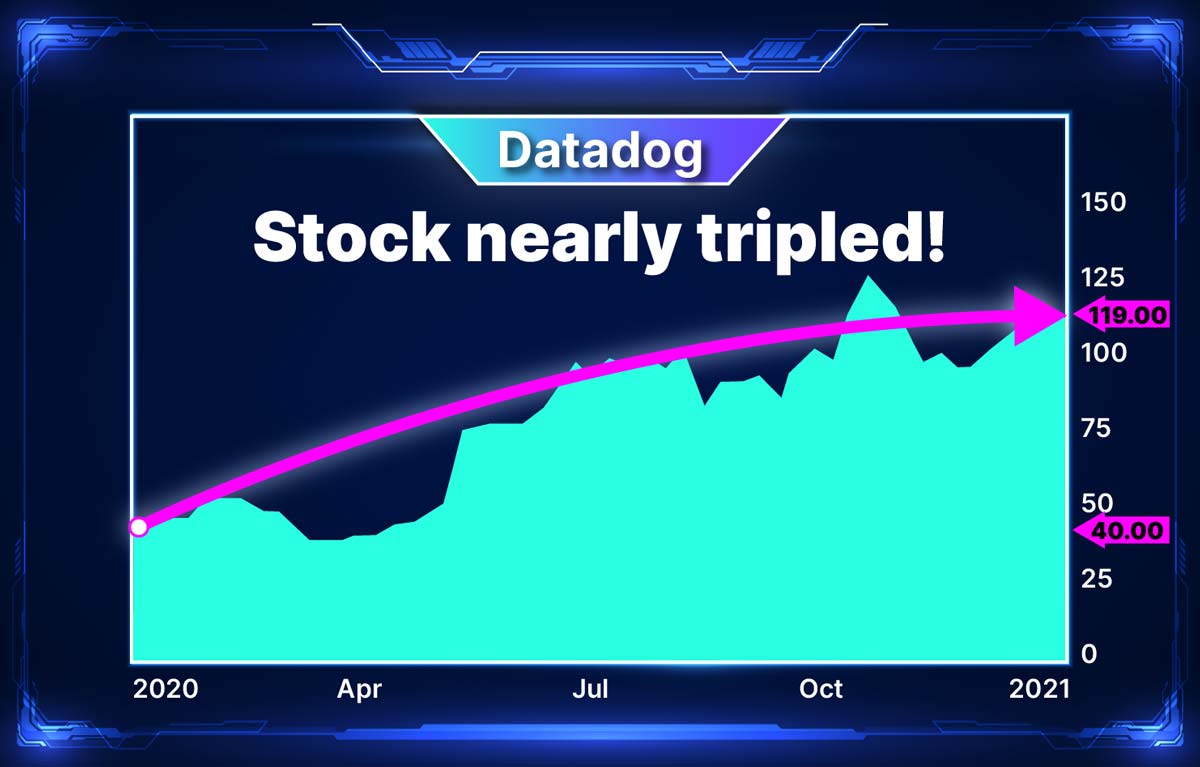

Datadog was almost a triple, it’s still up more than 2X…

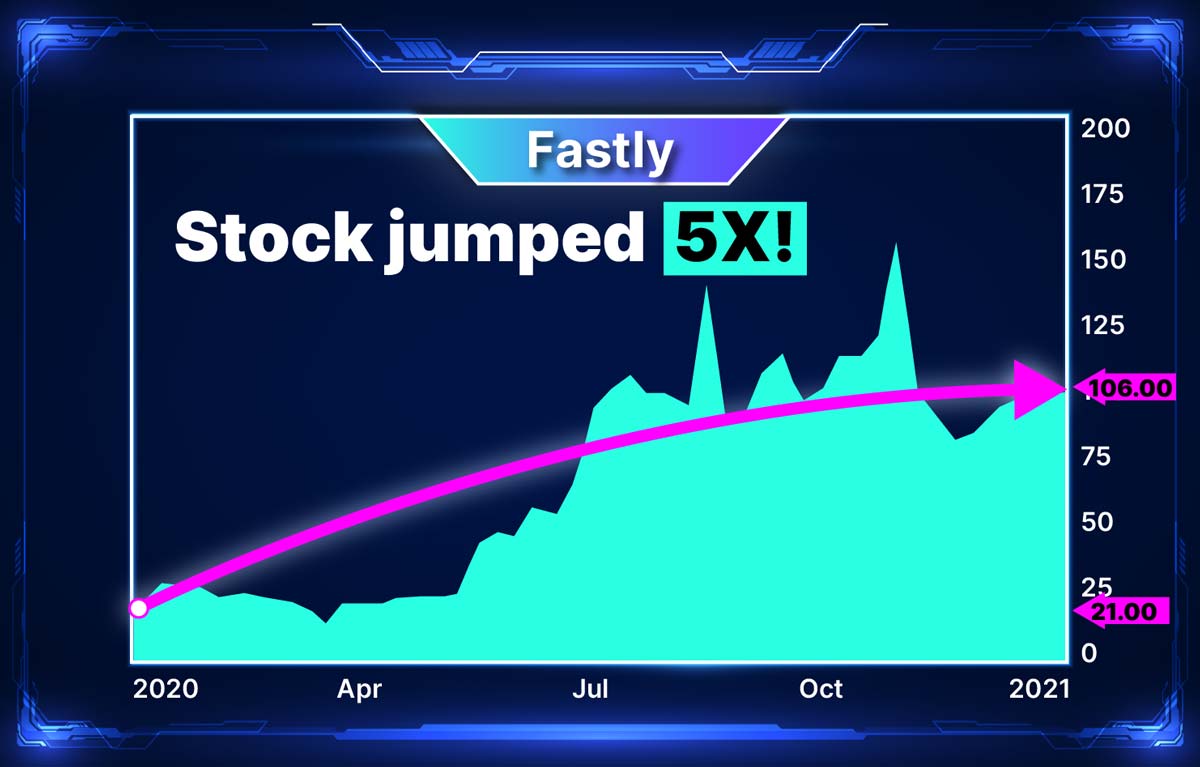

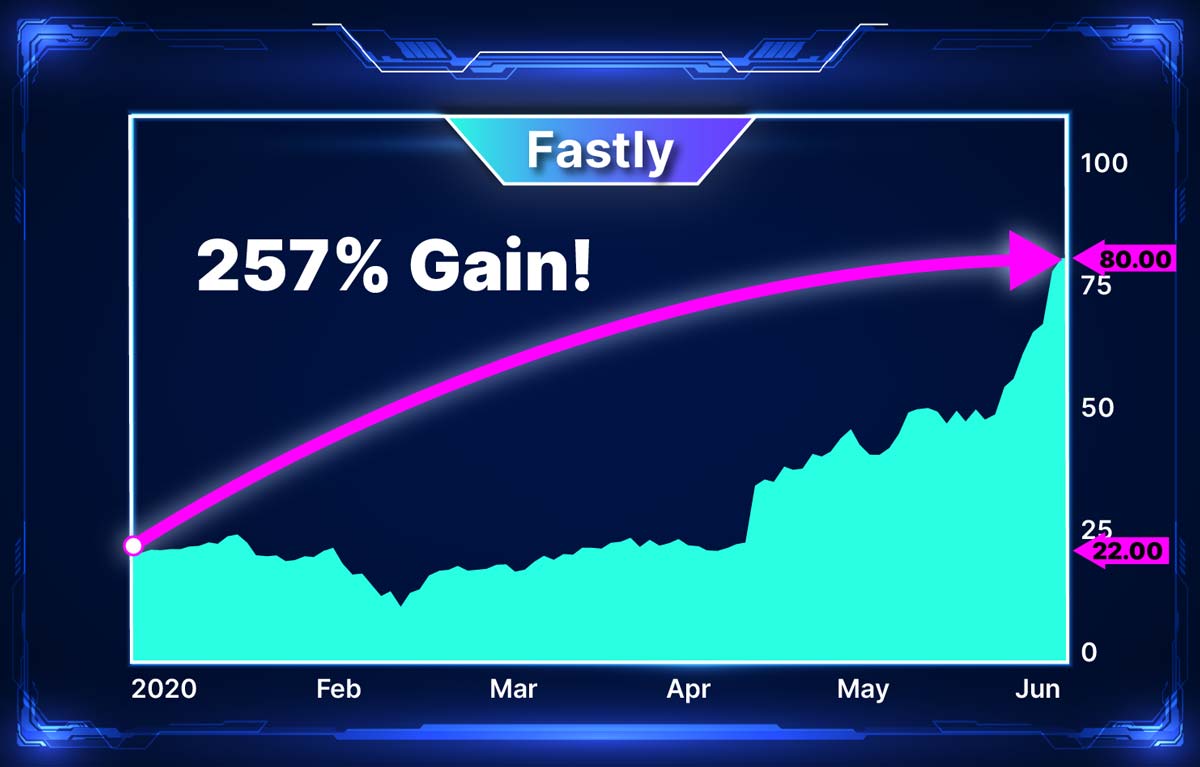

Fastly was up 5-times at one point...

We actually recommended Fastly last January. It went up so fast we actually recommended a partial sell and took a 2.5X return on half our position in just four months. We then closed the other half of the position and netted a 239% return in just over a year.

And those are just a few recent cloud winners that come to mind. How about all the cloud IPOs we saw too? There were so many last year I’ve lost count.

Host: But let me interrupt you here and play devil’s advocate…all the examples are great…but that’s the past. You said there was a new tech breakthrough that’s driving cloud forward?

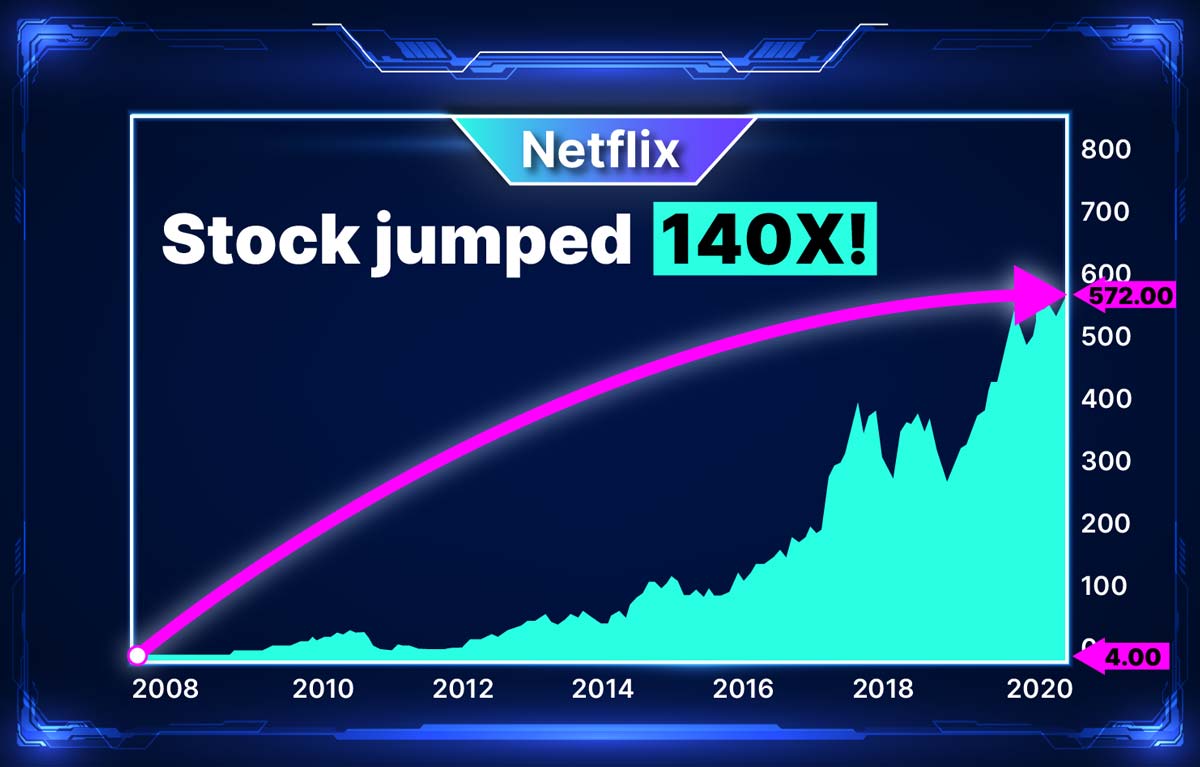

James: Yeah before we get there, we need to talk about Netflix for a minute. Netflix is the perfect example of how successfully integrating the cloud can turn a growing business into a powerhouse. Once you understand that, the true potential with this new trend in cloud technology should be obvious.

Host: Great, let’s do it, because I know people want to learn what they’re missing out on.

James: So we have to go back to August 2008… because the story starts when Netflix had a massive problem with their datacenters. If you don’t know what a datacenter is, it’s this…basically just a room full of computer servers. Everything on the internet these days is powered by computer servers. Servers go down, you can’t do anything.

Host: Ok I’m following you.

James: So what happened was, back in 2008, Netflix’s servers went down for three days… and they couldn’t access their database… so for three days they couldn’t ship DVDs to anyone. Now that was before everything was streamed online… but imagine how big of a problem that would be today if everyone who has Netflix couldn’t watch anything for three days.

Host: Yeah it would be catastrophic.

James: Exactly. And for a newish company back then, it was a massive, massive problem. But Reed Hastings and the smart people over there realized something that day that turned Netflix into the incredible growth story it is now. They realized that even though Netflix was very good at delivering video, maybe they weren’t so good at building datacenters.

Host: So what did Netflix do?

James: They turned to Jeff Bezos and Amazon who had just launched Amazon Web Services, their cloud platform. And Netflix decided to pay Amazon a service fee, so they could access Amazon’s datacenters in the cloud… or over the internet. When you hear something is in the cloud, all that means is that it’s over the internet.

So Netflix started paying Amazon a service fee for access to their datacenters over the internet. That small decision made all the difference in the world for Netflix. Because suddenly, instead of having to be in the datacenter business and the video business… Netflix could focus all its attention on their core business…and just pay Amazon for datacenter access.

And once Netflix was free to focus on growing its video business… guess what kind of explosive growth they experienced? Since that day, August 14, 2008, shares of Netflix have gone up as much as 140X!!! $5,000 becomes $700,000… $10,000 becomes $1.4 million as of October.

Host: Wow. That’s even better than Amazon. Ok so I think I’m starting to get this. So companies pay a service fee to get datacenter access over the cloud… for the same reason you don’t fix your own teeth or install your own air conditioning unit. Sure you could learn how to do it… but that’s a lot of wasted time taken away from your core skills. So instead, you just pay a dentist or electrician a service fee to do it for you.

James: Exactly. It’s basic economics…You focus on what you’re good at and let them focus on what they’re good at. If you’re running a business, that’s the best way to grow the company. Being able to focus on your core services is the benefit of turning to the cloud. And of course that just means more revenue and higher stock prices, and that’s how you become a trillion dollar company.

Now that was more than a decade ago. Back then, the cloud was just about getting access to these datacenters as a service…and you saw what that did for Netflix. Like I said, it helped them grow their stock price more than 140X...

And if that’s all the cloud did for growing companies today, it would still be a great place to look for tomorrow’s $1 trillion winners. Did other factors play a part in Netflix’s success story? Absolutely. But I have no doubt Netflix would not have achieved the success they have now without this technology. That’s why I’m using this cloud trend to target companies that I’m convinced will reach the trillion dollar mark.

Host: Yeah it sounds like it, I definitely want to look into all kinds of cloud companies just for my own personal investments.

James: Sure, but today, the cloud has evolved even further. And cloud companies are so advanced they can now deliver every technology you need to grow your company… as a service. This is the new cloud revolution I’m talking about.

For instance, you can now get your entire IT department… as a service. There’s a ton of cloud companies that offer some variation of this. One of them is called ServiceNow. The stock nearly doubled last year.

Here let me read this off their website…

So let’s play this out, Brian. Imagine, you’re Company ABC and I’m ServiceNow. For a fee, I’ll give you your entire IT department in a box. In one place you’ll have everything you need… the software, the applications, the data systems, the servers, the storage… everything you need to run the IT functions of your business. Would you rather do all that yourself or would you take the box?

Host: Obviously I would take the box.

James: Exactly, because now you can just focus on your core business. With all those essential business functions done for you already, how much faster do you think you could grow your company? A heck of a lot faster right?

Host: Yeah I would think so.

James: Right, and that’s why now more than any other point in history… it’s never been this easy for companies to grow. And to grow fast. And that’s why I’m convinced we’re going to see dozens of new $1 trillion companies explode out of this cloud-based services revolution.

Now I get it, IT isnt sexy. But if you’re a shareholder of a stock… and your stock goes vertical because the CEO smartly adopted the cloud for all its cutting edge tech solutions… what’s sexier than that? We’re all just looking to make money. And when good companies use the cloud to grow their business faster…that’s when you see exponential growth.

I mean, you want to talk about winning companies that benefited from the cloud… here are some of the best examples of that.

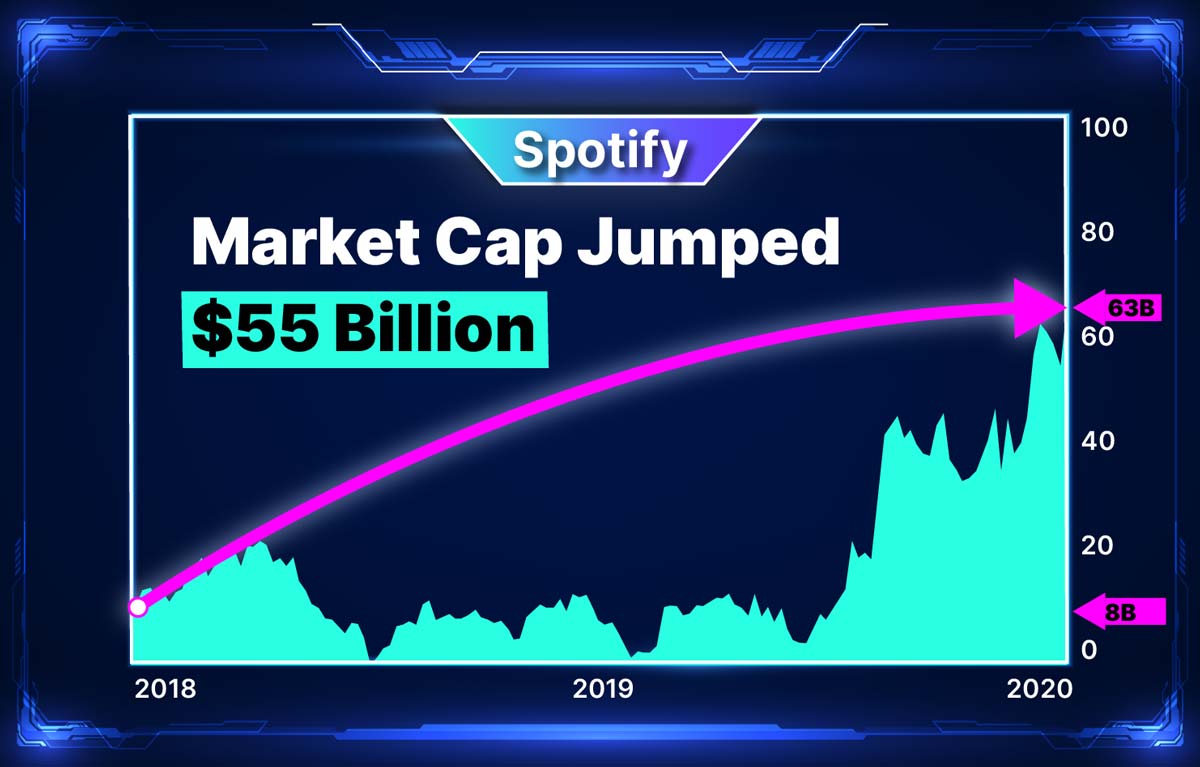

Just look at what’s happened to a company like Spotify. Since moving to the cloud four years ago, Spotify has been able to grow their number of paid users from just 30 million… to 144 million. That’s enormous, I mean that’s basically half of America right there. That’s the kind of growth that’s possible when you can focus on your core business. And its why Spotify’s VP of technology said,

Brian, any guesses for how much the company’s valuation has grown over that span?

Host: I don’t know, maybe $20 billion? That sounds like a lot…

James: Try $55 billion. In that time, their market cap has exploded from $8 billion… to $63 billion. And shareholders have more than doubled their money since the IPO so far.

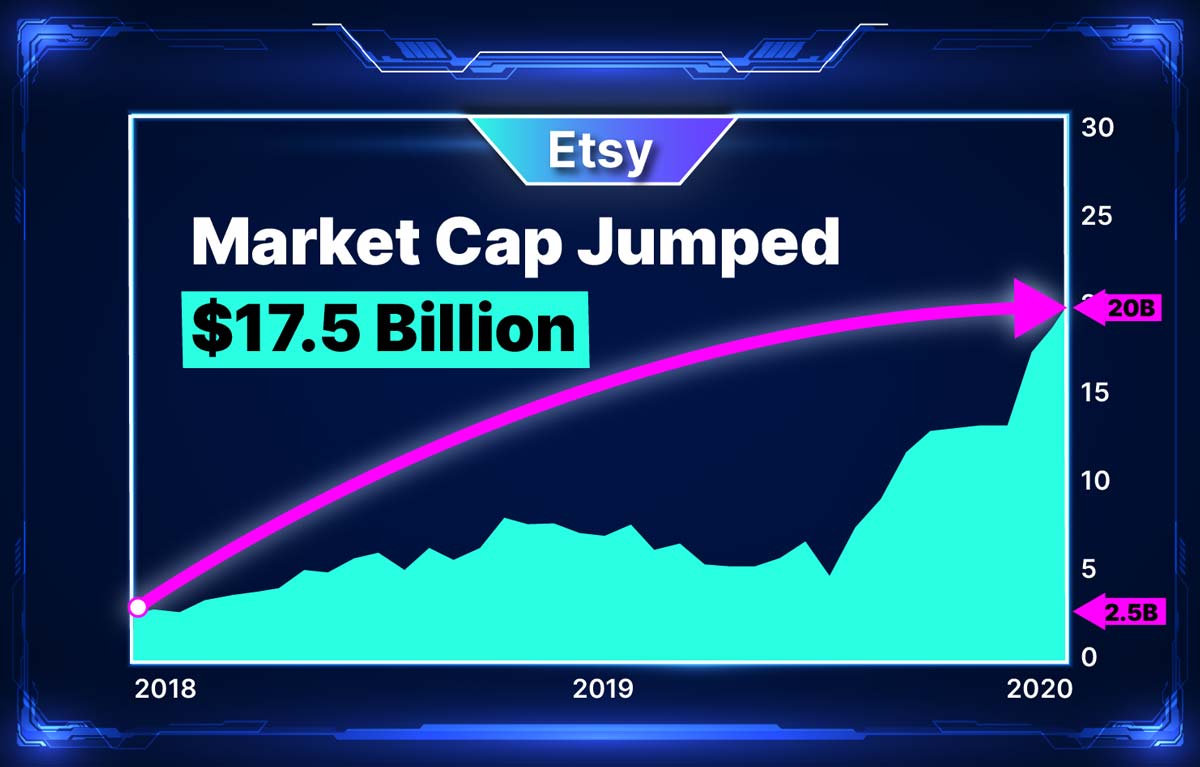

Host: That’s nuts. What about another hot company like Etsy that’s been in the spotlight recently?

James: Sure, Etsy is great example of cloud accelerated growth. Since Etsy moved to the cloud three years ago, their quarterly revenue has exploded 275%. And they’ve slashed their IT costs almost in half.

Host: Those numbers sound huge.

James: They are huge. And it’s done wonders for Etsy’s valuation. Etsy has jumped from $2.5 billion… to $20 billion in that time. That means the company has increased in value 8X.

Host: Wow, alright I see where you’re going with this. Is there one cloud-based company you can think of that’s really blown you away, growth-wise?

James: Sure look at e-commerce company, Shopify. Shopify has been on the cloud since March 2018. Since Q1 of that year, they’ve been able to grow the number of merchants on their platform from 659,000… to more than 1.49 million. These are just massive, massive numbers.

Host: So what are we talking valuation-wise… like a $70 billion, $80 billion jump?

James: North of $120 billion. Shopify has grown from a $13 billion company in March 2018… to now a more than $132 billion company. That means the size of the company has exploded more than 10X over.

Host: Unbelievable. I can’t tell you how many times I’ve heard Jim Cramer talk about Shopify on his show. Now I get it. What’s fascinating is how these are companies we’ve all heard of… or use regularly… that have blown up because of all these cloud services.

James: And here’s the thing Brian… Do you think in the future there’s going to be more or less of these services being delivered over the cloud?

Host: Well obviously more.

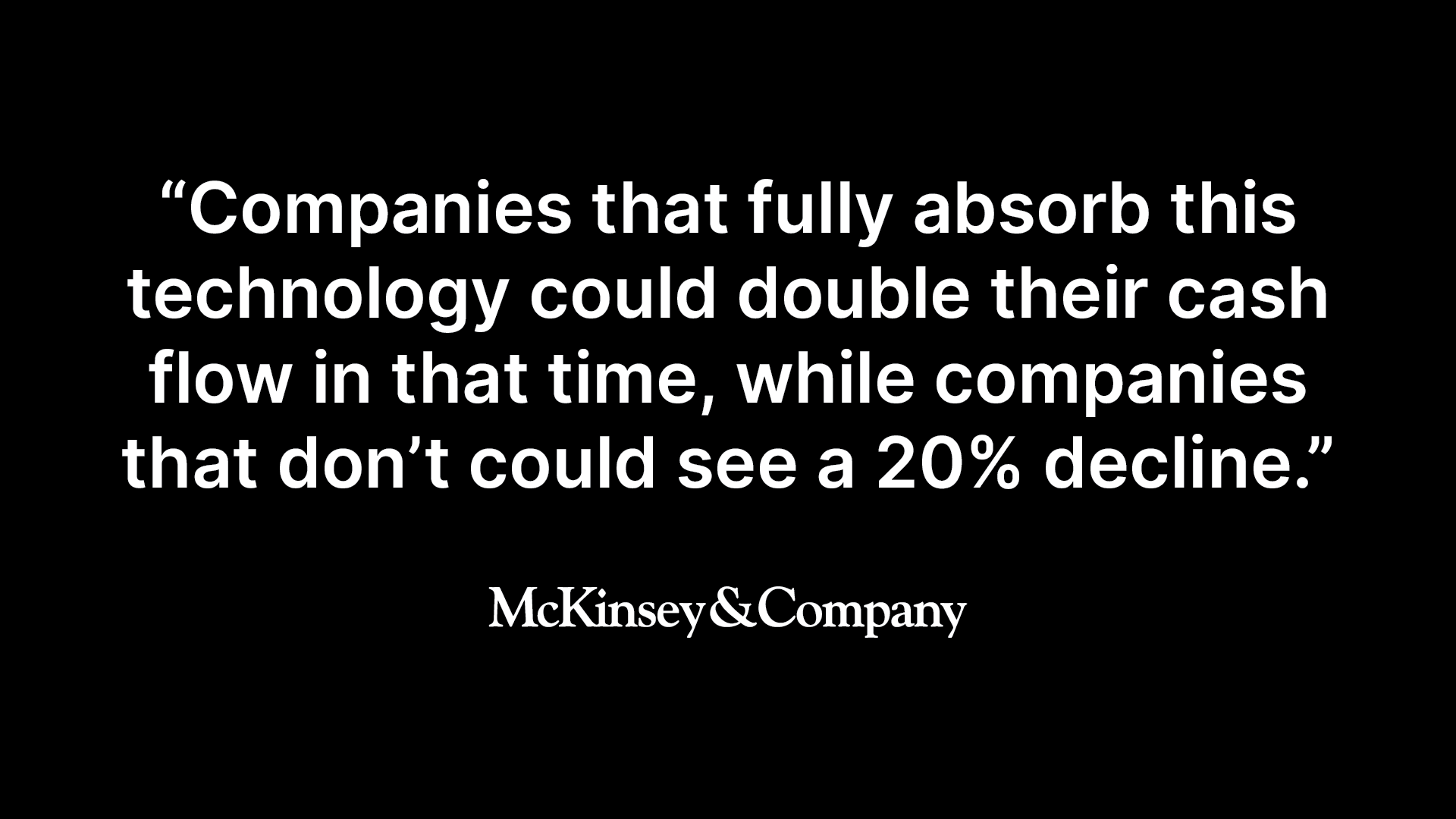

James: Exactly. Every technology that can accelerate growth will be offered as a service over the cloud. Take artificial intelligence for example… over the next decade, it’s estimated AI could grow the economy by $13 trillion. That’s insane. And according to McKinsey,

Host: So companies who use AI could make a ton of money… and companies who don’t could lose a lot of money… seems like you’d want to pay a service fee for that.

James: Yeah. Definitely. That’s why three of today’s $1 trillion companies, Amazon, Microsoft, and Google already offer artificial intelligence as a service.

Google’s AI cloud service, for example, lets companies incorporate cutting edge tools seamlessly into their business…. things like computer vision, natural language processing, and speech recognition.

Billionaire Michael Dell says of AI, “it will enable enormous advances in all human endeavors.” And he’s right. What this technology can do is incredible… In fact, NASA is using AI and machine learning over the cloud to accomplish tasks that would otherwise take years or decades… in just a matter of days.

But it’s not just FAANG stocks that are going to profit from it…and the potential is far bigger than just boosting NASA. This new idea of using cloud for essential services is going to touch every facet of the economy…

Host: Yes, and I know you have proof to back this up from what you found in your town. Let’s roll the tape.

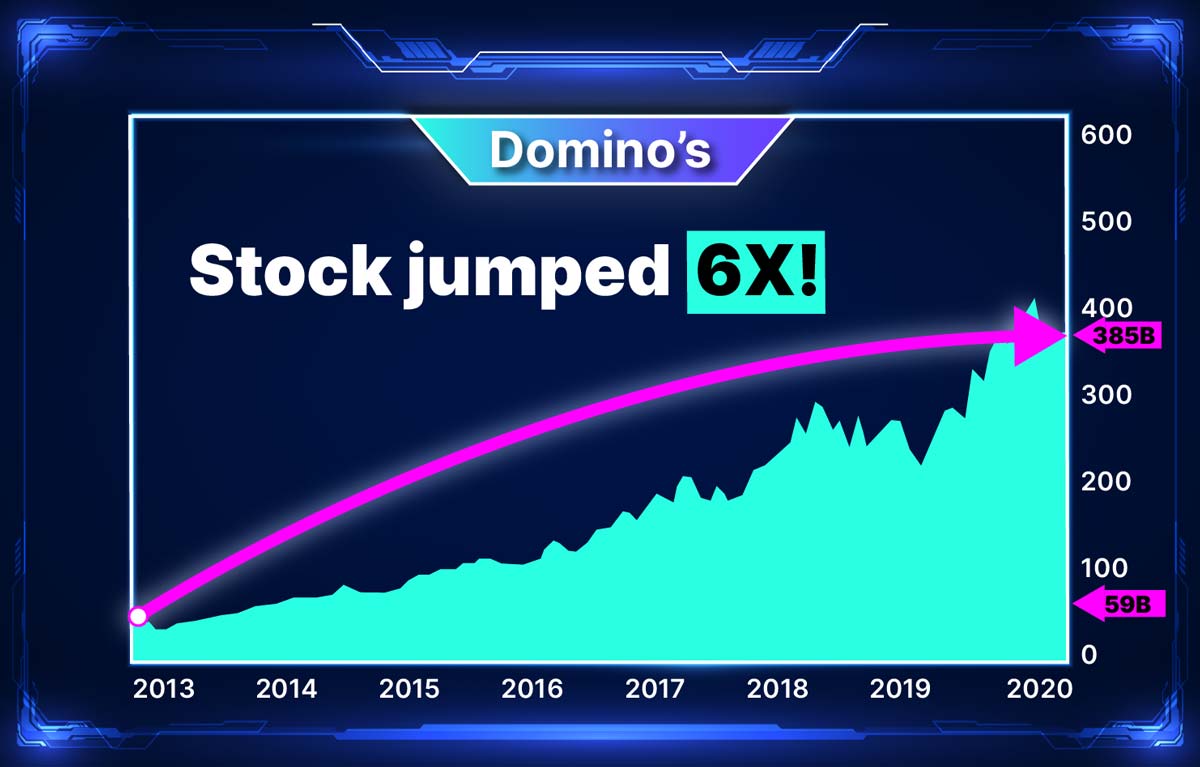

Host: Alright, so I see the point you’re making. All these services being offered over the cloud are literally transforming everything…from delivering pizza to exploring the moon and Mars. And these cloud services are helping companies grow their business like never before.

James: Exactly. Look, a decade ago Domino's was one of the worst pizza companies there was. But since May 2013 when they started using the cloud, they’ve become the world’s largest pizza delivery company. And shareholders have seen a 6X return on their money.

I like both groups of companies. And I think people should own a stake in both. I know we’re recommending both. But the portfolio of stocks I’m going to build tonight… it’s mostly from that second group. And I’ll tell you why.

Host: Great, please do.

James: Look as horrible as this pandemic has been, and I know it’s caused a lot of pain and suffering for countless Americans… but as bad as things have been, the one bright spot from all this is that it’s accelerated mass adoption for all kinds of cloud-based essential services.

I mean you suddenly have rock-solid companies in all areas of business realizing how fragile they are if things get bad. Look at how many companies had to cut huge chunks of employees just to keep the lights on.

Host: Right, it was like having to amputate an arm or a leg to save the body.

James: Yeah and so with the cloud promising to deliver all these new services with its technology, every company out there sees this as like a holy grail, for lack of words. Because not only does it let them potentially slash their IT costs in half… like what happened for Etsy…

But it lets companies grow their business bigger and faster than ever before… because they can now focus all their attention on growing the parts of their business that generate revenue and massively increase their bottom line. And obviously having more revenue is how you survive during the next black swan event, the next depression.

That’s why I believe the companies that stand to benefit the most, the ones I see coming out of this everything-as-a-service revolution at $1 trillion… are the ones delivering all these transformational cloud services in the first place. It’s a huge opportunity right now. And even though you may not realize it, word is starting to leak out. And it won’t be long before everyone sees the potential here.

I mean, just look at what other big VC firms are saying…you have a big one in Manhattan where the head of research there has even said publicly… “[these companies] are enabling the future economy we are going to have.”

Host: Yeah, earlier today you even showed me another statement like this that was published in The Wall Street Journal, which says,

James: It’s why you have cloud execs who call digital transformation “the opportunity of this generation.” Look tech billionaire, Orlando Bravo, made headlines when he told people around him to buy these companies. I mean this is what he said at a prominent gathering of elite financial leaders from around the world…

It’s probably why his hedge fund recently broke records, raising more than $22.8 billion.

Host: You used to run a hedge fund, what does all that money flooding in tell you?

James: It tells me people need to take this opportunity seriously. Nobody wants to miss out. And this is showing you that the time to act is now. And if you wait much longer to get in, it will be too late.

This is what Microsoft CEO Satya Nadella said about the company’s cloud-based software, Microsoft Teams, at the beginning of the pandemic, “We've seen two years' worth of digital transformation in two months.” That was last year. It’s only accelerated since then.

Even my buddy Jim Cramer is advising people around him that,

Host: So I want to stop you there…you brought up a good point about now being the time to buy these cloud service companies. We all know the pandemic has been going on for what it feels like forever now, is there any concern that all the companies that need these cloud services have already gotten them? That people who are looking to buy the cloud service companies may have missed that opportunity already?

James: Not at all. Not even a little bit. In fact, leading research firm Gartner forecasts nearly 70% of companies using cloud services will actually shell out even more money because of new business trends resulting from the pandemic. And that this shift will impact more than $1.3 trillion worth in IT spending this year and next.

Sequoia Capital, who we talked about earlier, who’s invested in 1,222 cloud service companies… calls it “the new DNA for IT.” In other words, this could be the #1 tech trend not only this year… but for years to come. That’s why you want to take advantage of this opportunity now.

Host: That makes lots of sense… but I still wonder, what about the notion that when things return to normal, and people start going back to work, and doing those kinds of things… will there be less of a need for these cloud services?

James: When I hear that I just laugh. That’s crazy talk. That’s like saying that once people started using the internet… that they would suddenly go back to doing things the way they did before the internet. This is the same thing. These cloud services have opened doors for many companies that were simply never possible before. And that’s never going away. As Gartner’s Vice President of Research says,

Host: Okay I can see your point. What company is going to want to give that up? And from what you told me earlier, this revolution is more than just democratizing technology… it’s democratizing wealth.

James: Yes, I mean we hear all the talk about how the rich are getting richer and leaving everyone else behind. Well, the people who invest in these cloud winners now… before those winners experience all this massive growth… before this new group of $1 trillion companies are born… those people will have the chance to make a fortune.

Host: Like you said from the start…if a company that’s worth $20 billion hits $1 trillion… that means the stock has grown 50X over. And a company that shoots from $10 billion to $1 trillion… that’s a 100X size increase. I can’t imagine being a shareholder along for that ride, right?

James: Right, the upside is incredible. We showed everyone that $10,000 invested in Amazon back in 2006 would’ve been worth over $1 million today. Imagine what $50,000 would’ve done. That’s generational wealth. Of course that doesn’t mean you should suddenly go betting the mortgage money or retirement savings here— whenever you invest you can lose money.

But after tonight, there’s no more justification as to why you missed this opportunity. You didn’t see Amazon 15 years ago, ok, most people didn’t. Trying to find these companies isnt easy.

I mean, Amazon was an online book store. Who could’ve predicted what they’ve become… or that Jeff Bezos would become so wealthy he’d step down as CEO at age 57. What’s revealing about that story though is the man he left in charge… Andy Jassy… is largely credited with Amazon’s massive cloud success… and Amazon Web Services.

So sure plenty of people have failed trying to find the next Amazon. And I’m not saying I can predict the future, because clearly nobody can do that. But if you just look at the facts we’ve gone through today, it should be obvious why we see successful cloud companies as our north star… so to speak… that’s where we want to point our compass to find these future trillion dollar winners.

James: I’ve said this before, and I’ll say it again… this is Silicon Valley’s best kept secret. Everyone has heard of the cloud, but still nobody knows what it can do for business. Most people have no idea all these technologies are being offered as a way to streamline backoffice services. And they certainly don’t recognize this is a trillion-dollar revolution.

But once people become aware of the true potential these cloud services really offer… what I’ve shared with you tonight… then the secret will be out. Knowing the way everyone likes to upload things to social media, I wouldn’t be surprised if we see video clips from tonight out there tomorrow. So this really could be your last chance.

Host: Yes, and that reminds me, please if you’re recording this event tonight, please please do not upload any part of the event until after we’re done. That way everyone watching has a fair shake before the general public.

James: I think every American should have some exposure to these cloud companies. Now you’ll have to decide whether that means 5%, 10%, 25% of your portfolio or more. But you’ve seen the proof… you’ve seen how this cloud service transformation is happening everywhere… you’ve seen how high these cloud stocks are going… and now, hopefully, you understand why I’m convinced this is where we’ll find tech’s new $1 trillion winners.

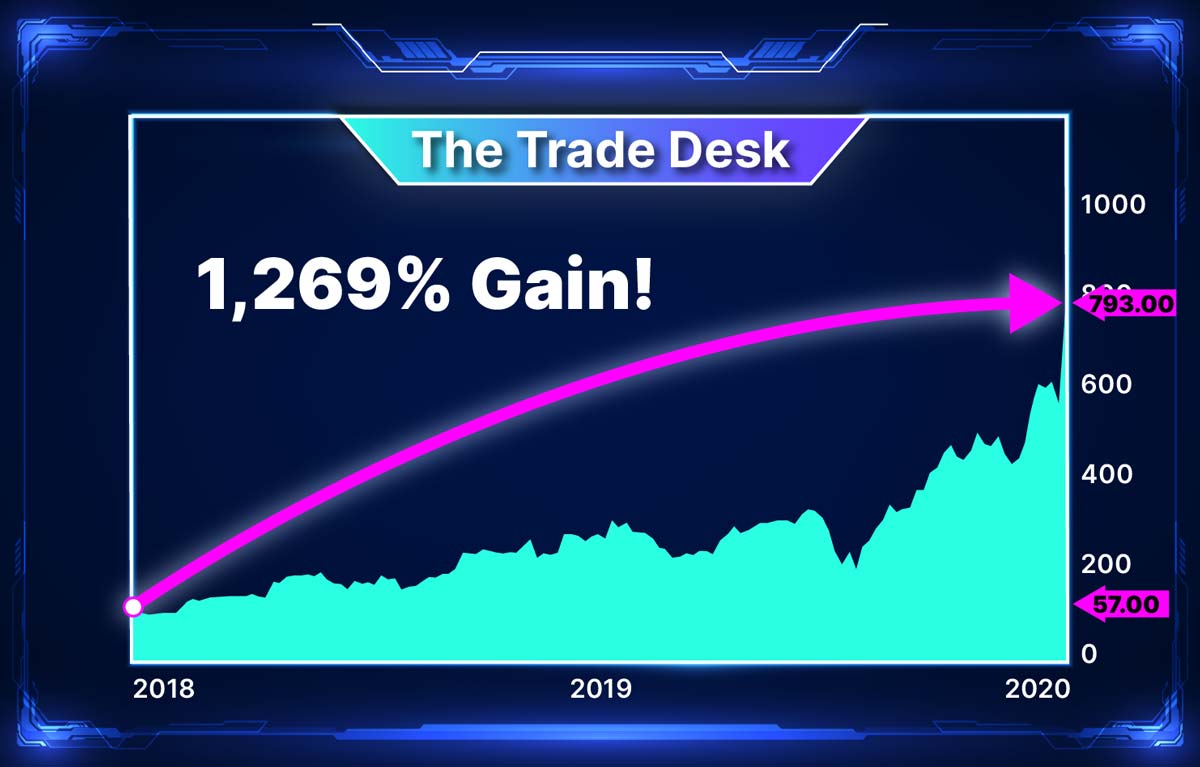

We’ve already helped our readers make a bunch of money… I told you about how we recommended a partial sell on Fastly with half our position for a 2.5X return. That trade worked out so well, when we closed the rest of the position we caught a 239% net return in just over a year . And one of our other recommendation on The Trade Desk was even better. We recommended a partial sell there that netted a 477% return in three years.

Host: Now James is going to get to these potential $1 trillion winners shortly. But if you’re watching and you’re wondering whether it’s possible for you to get even more access to James… his thoughts on all things tech… and to even learn more about this cloud revolution than what he’s sharing with you tonight… I just want to start off by saying yes, it is possible. But possible right now is the key word. Because later James is going to make you a very special offer that he hasn’t shared with anyone before tonight.

Can you tell us more about this opportunity James?

James: Sure. Right now, my team and I have what we call the top 1% core portfolio… this is my core model portfolio of all kinds of tech companies… every week we send our analysis and follow up with a new recommendation monthly… we recommend everything from cloud services to… artificial intelligence… to biotech. You can see a snapshot here of some of our biggest winners, sorry I have to blur the names and tickers.

Host: Wow. That’s a lot of green.

James: Yes, we’ve done really well. Our recommendations have averaged 32% with a holding time of 585 days, and that’s since 2015. As a former hedge fund manager, I know that’s better than even the best hedge funds. And because we’re an independent financial publisher, we don’t manage your money so we don’t charge performance fees.

I don’t know anyone else who’s doing that and letting people in for the price we have tonight. Look, some of our best winners have already returned 239%... 346%...477%, with the highest part of that trade soaring to 1,269%.

These are gains that took one, two years to play out. And our readers have probably since cashed out with two and a half times, three and a half times their money or more. But if you want access to these recommendations as we’re making them in real time… that’s part of this special offer we have for people who join my Top 1% Advisory research service later this evening.

Host: But before we get to that special offer, James, are you ready to show the world what we’ve been talking about? Are you finally going to tell us about this portfolio of potential $1 trillion winners?

James: Yeah I think now is the perfect time.

So I saved the whiteboard for this, let me go over here and get it… I have to write down the names and tickers of these five companies. Apologies in advance for the handwriting.

Host: I can’t wait to see this. James hurry up over there.

James: Alright, I’m done. Now Brian, I want you to take a look at this whiteboard and can you confirm there are five stocks with tickers on this list?

Host: Yes, I see five names and tickers here.

James: Great, now can you verify for the folks at home that you can find each of these companies in a regular brokerage account?

Host: Sure let me grab my phone and I’ll do that right now.

James: While Brian does that, I’m going to tell you a little bit about each of these stocks… and why I’m convinced thet could each end up potentially hitting $1 trillion.

So Stock #1 is addressing a $1.2 trillion market opportunity. Now keep in mind that’s as of today… that doesn’t account for the market opportunity to grow further, which is inevitable considering how fast this industry is growing. Oh and on top of that, during Q4 2020, this company’s revenue skyrocketed 145% year over year.

Stock #2 is already a market leader in it’s category with a 40% market share in America and a 31% market share in Canada… and yet the CEO recently told shareholders it’s total addressable market is so big it accounts for every future dollar that will ever enter this category…

Stock #3 is coming off an unbelievable quarterly revenue growth with 64% year over year in the U.S. and a whopping 145% growth internationally. Cathie Wood, who’s ARK fund recently bought over 108,000 more shares of Tesla… also has a huge stake in this company.

Host: Yep I can confirm all five of these picks are available in a regular brokerage account.

James: Stock #4 is a $6 billion company that’s so explosive we don’t even want to wait for this to hit $20 billion to start looking at it. (That’s usually where you find companies that could hit $1 trillion… but this one is just too good to pass up right now.)

Stock #5 has one of the highest dollar-based net retentions I’ve ever seen. Anything over 100% means they’re selling more services to their existing customers. Well this company’s dollar-based net retention is 137%. That’s incredible, just absolutely amazing. Oh and like stock #3, Cathie Wood also has a massive stake in this company… more than 1.1 million shares at the end of 2020.

Host: Is there a time period you see, that maybe the first of these companies will potentially hit $1 trillion? I imagine clearly it’s not going to happen this year.

James: No, this is definitely something that will definitely take years to accomplish. But here’s the thing… besides stock #4, we’re talking about companies worth $10-$50 billion right now. If I’m right, the company doesn’t have to hit $1 trillion for you to see some really huge gains as share prices blast higher. I mean if we use the Shopify example from earlier…

Shopify went from a $13 billion company in March 2018… to a more than $132 billion company today. That means anyone who held shares watched the company soar 10X in value, with a 600%+ return.

Host: Right that’s enormous. Yeah so the payoff on these stocks really can be as big as you’re willing to stick around for. If James is right, and these companies’ market caps take off, there’s nothing preventing you from cashing out with your gains whenever you want. If you want to sell your shares while the market cap is at $100 billion… $200 billion… $500 billion, you can always take your gains and move on.

James: Yes, exactly. I love that about this opportunity because it gives people the flexibility to do what they want. Put in what you want. Sell when you want. Obviously the more you invest the more you risk, and there’s always the chance that these companies go south…that happens sometimes too.

But even if I’m only 50% right, no let’s say I’m 25% right… and a $10 billion company becomes a $250 billion company instead of $1 trillion… that means the company would’ve increased in size 25X over. That’s a huge return on your money.

Host: Wow. 25% right, I can’t say I’ve ever heard that before, but it’s the truth. Just being a sliver right on a company that could hit $1 trillion would make anyone a lot of money. So James, if people want to get started with the names of these five companies right now, how do they do that?

James: Sure. So this special portfolio, a report I’m calling “To $1 Trillion And Beyond,” this is a bonus only available for people who join my Top 1% Advisory research service tonight. We’re not putting this up for sale anywhere else. This is a totally unique opportunity and we’ve never done anything like this before.

Host: Not to interrupt but just want to clarify that your current readers will also be getting this special bonus tonight.

James: Yes, absolutely. Every reader current or new will get access to the companies I believe will go to $1 trillion … including my full writeup as part of this brand-new report “To $1 Trillion And Beyond.”

And just to finish what I was saying… when you combine the names in this special portfolio report with the current model portfolio… our readers are getting a one-of-a-kind, balanced opportunity to profit over every period of time. Short term, medium term, long term… And they’re also getting exposure to companies of all sizes… microcaps… small caps… medium caps… and some large caps too. It’s the whole package.

Host: What appeals to me personally about tonight’s offer is that you’re not pigeon-holing anyone into anything. You’re not saying, this is my system. You either fit my system or you’re not going to make any money. What you’re doing is offering people the flexibility to tailor what you recommend… with their own financial situation. And that you’re just putting everyone in the best position possible to succeed.

Host: If you’re wondering what access to this kind of research might cost, James do you want to share the details of this special offer?

James: Yeah and I mean I think the key word here is “special”. Normally we charge $5,000 a year at the retail price for access to my Top 1% Advisory research service. But if you join us tonight, we’re going to drop the price all the way down to $995.

Host: Wow. So not only do you save more than $4,000 right off the bat… but you get the core model portfolio… you get all of James’ insight and analysis… you get weekly updates… you get at least one new recommendation every month with an alert in real time… and that’s not all, because I know there’s another bonus gift you’re giving everyone too.

James: Exactly. That’s exactly right. And not only that but people who join tonight are saving $4,005 off the retail price. Normally a one year membership to Top 1% Advisory costs $5,000… but through tonight’s special offer… you can get that for just $995.

Just to break that down for you… that works out to $2.73 a day… And in return not only do you get the names of five potential cloud winners that could hit $1 trillion… but also you get all the weekly research and insight from me and my team… plus you get a new monthly recommendation. And this pick could be anything from cloud services… to artificial intelligence… to biotech.

Host: And if you’re wondering how valuable that $995 subscription is… let me read you this note from one of James’ subscribers…

“This is a fine distillation of information worth every penny. I have found strong gains, as well as incredible gains of 180%, 80% and 50% in 8 months or less (100% average!) I trust James based on his background, authenticity, and his methods of choosing investments. I think acting on his recommendations will lead to my financial freedom.”

— NANCY D.

(For more typical results, click here.)

James: That’s a very nice note from Nancy. And if she put just $750 into that recommendation that returned 180%... she would’ve ended up with $2,100. That’s more than enough to cover the subscription fee right there.

Host: So there you have it. Just one recommendation could cover the entire subscription cost.

James: Exactly. And you know what, because of how exciting this cloud opportunity is right now, I’m going to give everyone watching a free cloud stock pick.

Host: You’re going to give everyone a free recommendation, just like that?

James: Well it’s a company that’s on our watchlist, but I absolutely love this stock.

Host: Well, now I’m intrigued. What’s the name?

James: The company is called Magnite (MGNI)… and they’re a tiny $6 billion stock chasing after a market that could hit $526 billion in the next three years. If they capture just a fraction of that, the sky is the limit. The price I’d feel comfortable recommending this would be at $25 a share… so if you can catch it on that pullback, I say you gotta pull the trigger.

Host: Wow, again that level of insight is the difference between James and any other so-called expert out there.

James: Yes, and look, we also just did a full length eight-page write up on Magnite-- because that’s how much we like this stock. And anyone who takes us up on this special offer tonight for Top 1% Advisory… can get that bonus report completely free.

Host: Look if you’re still on the fence about whether or not it’s worth to have James guide you through this cloud based services revolution… and whether joining Top 1% Advisory newsletter is right for you… James is about to reveal what he calls his “Road to $1 Trillion” formula here in a moment. This is the criteria he’s looking at to find these future winners that he believes could hit $1 trillion. So you can see what goes into each of these recommendations and then decide whether you think you can do this work yourself. You’ll also see footage from a conference he held for readers of all his research services… these are people who flew across the country just to hear James speak for a few hours. You can hear what they have to say about having James as a financial guide and factor that into your decision too.

But for everyone else who can fully see the potential opportunity awaiting them… who’s already decided they’re ready to take the next step… please make sure you get your order in tonight. I would hate to see you miss out on this incredible opportunity to get those five potential $1 trillion winners…. and to get access to all of James recommendations… and to save more than $4,000 off the retail price on your subscription. So if you’re ready to place your order right now, just click the button below. It will take you to a secure order form where you can get everything we talked about tonight.

And with that, James, let’s get into what you call your “Road To $1 Trillion” formula now.

James: Sounds good, I’m ready.

Host: Alright, so I know this formula is how you’re looking for these top cloud service companies… the ones you think could hit $1 trillion. But I have to ask… how are you actually finding these companies, are you looking at earnings?

James: No and I’m glad you asked me that. Because if you just listen to Wall Street and you try to pick these companies based on who beats earnings estimates, you’re going to miss all these winners. Look, Wall Street has crafted this amazing narrative over the years that the only way to make money is by looking for companies that beat earnings estimates. Why? Because that’s how they stay relevant. They want regular people to think they need Wall Street, that people need their estimates. But Brian, think about this. What is an earnings estimate?

Host: It’s their estimate of the company’s earnings, right?

James: Exactly. So all that really means is that the company does better or worse than Wall Street expects. So if a company beats on earnings estimates, what the heck does that tell you about the company? Nothing. It just tells you Wall Street was wrong. And they’re wrong a lot. In fact, on average 72% of companies in the S&P have beaten Wall Street earnings estimates every quarter for the last five years.

Host: Wow, I guess I never thought about it that way.

James: And here let me make one more point about earnings and then we’re going to move on. I’m sure you’ve heard of Price to Earnings ratio right, P/E? That’s another buzzword metric Wall Street likes to throw around.

Host: Sure. Absolutely.

James: Right, it’s a measure of profitability. And the common misconception is that if a company generates a lot of earnings and its profitable, then it must be a good company right?

Host: That’s what I would’ve thought.

James: Sure, but the truth is… the best companies don’t focus on simply generating profits. Here, let me pull up Jeff Bezos’ 1997 letter to Amazon shareholders, so you can see what I mean. He says…

In other words, Bezos was more concerned about growing Amazon as a business than short term profitability. And that’s probably one of the biggest reasons Amazon was able to hit $1 trillion. Because their huge investment in the cloud back in 2006 helped spur that kind of growth. Bezos has reminded shareholders of this long-term focus by including it on every shareholder letter since. Every single one.

Host: Alright, I see your point. So earnings can be manipulated, earnings season is just a show really… and the best companies focus on growing their business long term.

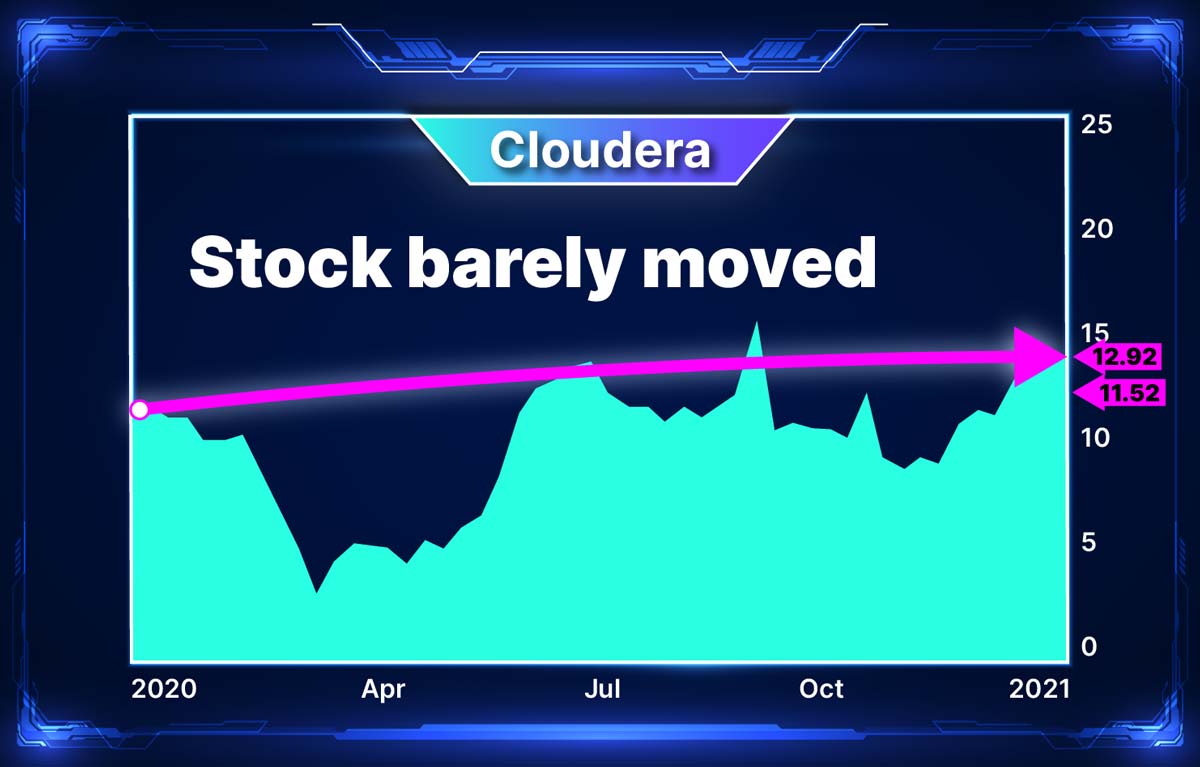

James: Right, you have to really understand what you’re looking for… what you want to see to find these cloud winners… or you’re just going to miss them. And you’ll end up with some half decent buys… or worse, a big loser. Look even the best investors can’t win them all, and we certainly have our fair share of losers. And just like any other kind of company, not all cloud companies are big winners. Look at company like Cloudera… while most cloud companies were soaring last year, their stock barely moved at all.

And it’s actually lost people a lot of money over the last five years.

Host: Okay, so what is the #1 thing you look for to find these cloud companies, if it’s not earnings?

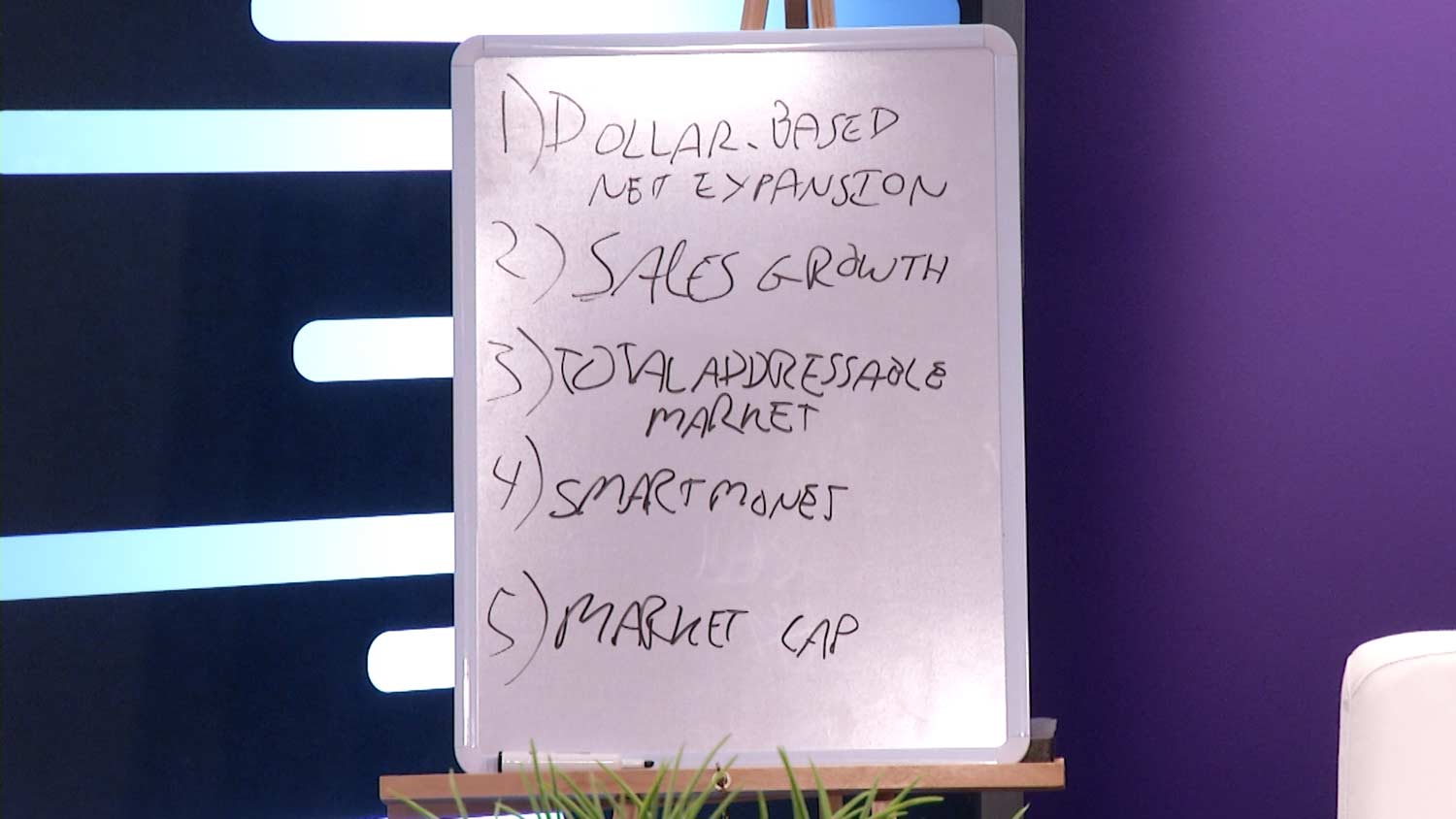

James: Well, I don’t just look at one thing… there’s a ton of metrics I’m watching, but there are five criteria I look at above all else. Every tech investor should know this stuff. This is what you definitely want to look at to find cloud service companies. It’s the core of what I call my “Road to $1 Trillion” formula. Before we move on, this is really important, so I’m going to write these five things down for everyone to see here. Let’s get that whiteboard again.

Host: Wow. That’s a lot to unpack there.

James: Yes, we could spend a whole event just talking about these five things. But because we still have a lot to get to tonight, I’m just going to touch on each of these criteria briefly.

Host: Ok, so dollar-based net expansion, tell us about that.

James: Sure, so let’s talk about Fastly. Because that was one of our favorite cloud recommendations last year. I’m not going to get into what the company does, because the point I want to make is that if you understood dollar-based net retention, then this would have been a no-brainer to look at right away.

Dollar-based net retention rate of 100% means sales to their existing customers were flat, no growth. Under 100% means sales to existing customers shrank… Well, when we recommended Fastly on January 31, 2020, they had a dollar-based net expansion of 135%. That’s insane. All that is, is a fancy way of saying Fastly’s sales to their existing customers expanded 35% year over year. … that’s 35% more than 100.

Host: Right, so that means the company’s customers were spending more money. So the company was making more money.

James: Exactly. It’s easier and cheaper to make a sale to an existing cutomer than a new one. And not to jump ahead but if you combine Criteria #1, a high dollar-based net expansion… with Criteria #2, a high sales growth… you can tell the company is making a TON of money not only from its current customers but from its new customers too. You want all your customers to buy more…your current and new customers. If your new customers pay up and then leave after one year, that’s not really a business I want to invest in.

Host: Got it.

James: Yes, so we knew immediately from seeing that, there was a good chance Fastly would be a slam dunk. And it was. That pick went up 257% overall in one year’s timespan.

So that’s kind of a combination of dollar-based net expansion and sales growth. Another recommendation we made that had an extremely high sales growth rate was on The Trade Desk. They had a monster year in 2018 when we recommended them, annual sales grew nearly 55% year over year. And like I said earlier, we recommended people partially sell their stake for a 1,269% gain in two years… and then recommended closing the other part of the trade for a net return of 477%. That was a big one.

Host: Wow, I know you’re about to get into your next criteria, but I just want to point out that this deep analysis and expert insight… this is what you get when you have someone like James on your team. And when you have the tremendous amount of opportunities, all the companies James is watching with these criteria… that’s just too much to go through for most people. So why not let James do it for you? Just click the button below here to get started. And make sure you lock in that amazing offer James has for you tonight. $4,005 in savings… and the names of five potential winners that could hit $1 trillion… wow.

So that brings us to your Criteria #3, Total Addressable Market.

James: Yeah not going to spend a whole lot of time there, that’s pretty obvious. You want to buy companies that address a huge market. Look at Airbnb for example. When they went public in December, the company touted a $3.4 trillion total addressable market. Obviously they cherry picked that number a bit to address the entire travel industry vs just their target market but you get the point. Bigger is better here.

Host: So we’ve talked about Criteria 1-3, can you tell us about smart money? Is that just following insiders?

James: Great question. Yes but with a caveat. So there’s smart money… and then there’s smart money. Like I said earlier tonight, one of the best investments I ever made was when I followed Peter Thiel into tech startup, Buddy Media. Five years after I got in, Salesforce bought them out for $689 million… And I made a 5,700% return.

Obviously, Peter is a fantastic investor… he was the first outside investor in Facebook back in 2004 and invested $500,000 when the company was worth only $4.9 million. Today Facebook is worth over $700 billion. He’s also made early stage investments in now-well-known companies like Airbnb, Linkedin, Yelp, Spotify, SpaceX, Asana, and Stripe. So Peter would be a great example of the kind of smart money you should pay attention to.

But there’s a second part here I want to mention as well. When you look at smart money, you also have to consider what kind of stake the investor is putting in. I want to see a hedge fund that’s put in so much money that if the stock goes down, it hurts. You have to make sure the smart money you’re following isn’t just play money… and that it’s a real sizeable stake. So that’s my spiel on smart money.

Host: And last but not least, can you tell us about market cap? I don’t want to assume there’s anything obvious after what you just said there with smart money, so tell us what you mean by that…

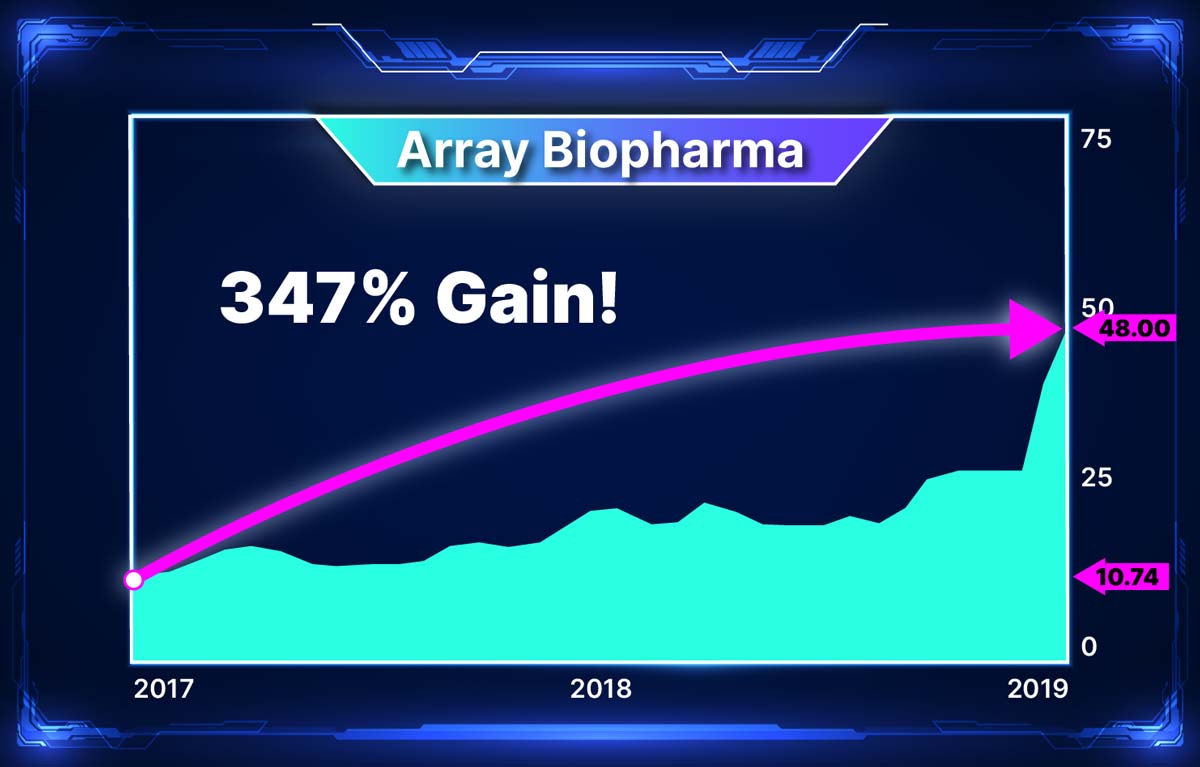

James: Sure, so this one actually is pretty straight forward. The smaller a company is when you buy, the more room it has to run and the more money you can make. We recommend a lot of these kinds of companies… We recommended a small company called Array Biopharma in December 2017 at $10.74 a share. The company was actually so successful that Pfizer bought them out two years later and we closed that position for a 347% gain. A 3.5X return on your money.

But if you’re looking for the companies that could hit $1 trillion… for the most part, you want to look at this differently. You don’t want to chase tiny companies… what you want is a company that’s got a proven model, that’s churning out massive revenue, and it’s just a matter of time before everyone realizes it. So for these cloud service companies, you should be looking for a company that’s worth billions… honestly maybe even up to $50 billion. And you may say to yourself, “well James, $50 billion is huge. How am I going to make any money on that?” Well $50 billion is a nice number, but then you compare that to $1 trillion. That’s the chance to catch a ride on a company that could increase 20X over. If it’s a $20B company or a $10 billion, you could be looking at a 50-100X increase in size.

Host: Wow. So you’re looking at all five of those things plus all the other criteria you couldn’t even share with us… to find those companies that could hit $1 trillion.

James: Exactly. Look the point is, there’s a right and a wrong way to go about picking these future winners. Could you get lucky even if you don’t know what you’re doing? Absolutely. But as you can see, there’s a lot more than luck that goes into finding these elite cloud service companies. And that’s why you should know you don’t have to do this alone. If you join my Top 1% Advisory research service, I’ll do all the hard work for you.

Host: And to bring up the fixing your own teeth analogy from before, you could spend all the time and money and research necessary to find some of these plays that might work out. But that would take away from your job, your kids, your family. And if you’re wrong, you’ll have to spend even more time and money and try and correct your positions. Why not focus on what you’re good at, and let James do what he’s good at?

James: Yeah I mean talk about a good growth strategy for a company… that’s a good strategy to grow your portfolio too. Since 2015, we’ve consistently delivered the chance for readers to make a lot of money. Our five year average return is 32%. That’s remarkable. The S&P 500 returns 10% on average… we’ve done 3X better than that. And our best gain was 477% in three years.

Host: This is your chance to have a true expert working to hit it out of the park for you on every swing. You can get started by just clicking the button below. And definitely don’t wait on this, I would hate to see you miss out on on the biggest gains from these five picks because you didn’t act tonight.

And just so people watching at home recognize what an incredible opportunity this is to have James leading the way… I want to share a brief 60 second video clip from a big event James held before the pandemic. Many of James subscribers to all his services flew in from all over the country just to hear him and his team speak. These are regular Americans who all recognized the unique opportunity of having James guide them through the financial markets. So what might it mean to have James on your team? Well I think it’s best you just to hear it from them.

(For more typical results, click here.)

Host: Wow that’s some very kind words for you James.

James: There’s nothing more I love doing than helping people take full advantage of explosive situations in the market. It’s why we’re having this event tonight.

Host: Exactly. Don’t forget to click the button below. You don’t want to be kicking yourself later that you missed this. Now before we sign off, James is there one last thing you want to say… a few words maybe that you could tell people who still can’t see the full opportunity in front of them tonight.

James: Yes and it has to do with Steve Jobs. Look, if you ever saw one of Steve’s famous Apple product unveilings, you know he would always make his pitch… and then right before the speech ended, he would come back out with one last thing. One last thing, a product, a gadget whatever that he thought would blow people away. Well, the last “one last thing” Steve ever pitched before his death, was about the iCloud in 2011. Fitting right, since this entire night has been about how the cloud has helped launch all of today’s $1 trillion winners… and how cloud services are now about to do that again with a whole new group of companies.

Look I wish I saved one last thing to blow you away here, but we’ve done so much tonight I’m just going to end on this. I want you to ask yourself… what if I’m right? How would you feel if you missed out on one of these potential $1 trillion winners?

We all saw how confident those guys were who laughed in my face when I said Apple would hit $1 trillion… when I said Apple would hit $2 trillion….And of course, I was right. So if you’re going to pass this opportunity up tonight, I just want to say… I hope you’re really confident. And I wish you the best of luck.

Host: Well I’d imagine you’d have to be pretty confident if you still can’t see the profit potential here…if you just sat through this whole event and still can’t see it. Alright James, thanks for joining us tonight. I’ve said this over and over again and I’ll say it one last time… please, please make sure to take advantage of this amazing opportunity you have here. This is a historic moment and I know James wants you to be part of this. You still have time to get your order in now. Just click the button below to get started. If you want to stay on this page here while you make your decision, James has said we can leave this page open tonight. And with that, I’m Brian and thank you for joining us this evening. What a special evening it has been.

To $1 Trillion And Beyond, April 2021